bank owned life insurance regulations

The insureds are employees. The bank is the owner of the policies pays all premiums typically a single.

Banking For Newcomers To Canada Banking For Newcomers To Canada

It is only for banks and corporations who purchase it for specific employees often executives.

. We specialize in helping executives and business owners navigate the various ways businesses and institutions implement life insurance as a strategy. What Is Bank Owned Life Insurance. Ad Funerals are expensive.

Although this statute pre. The federal banking agencies are providing guidance on the safe and sound. Purchases of life insurance that have been found to be incidental to banking include insurance taken as 1.

BOLI is the acronym for Bank Owned Life Insurance. The interagency statement also provides guidance for. The primary benefit of BOLI is its treatment for corporate income tax purposes.

Bank-owned life insurance or BOLI is a type of permanent life insurance bank purchases with an idea to offset existing employee benefit expenses. Help protect your loved ones with valuable term coverage up to 150000. As of December 31 2020 3137 banks nationwide reported cash surrender.

However if the BOLI policy is transferred for value ie the. Bank Owned Life Insurance Rules and Regulations. No Medical Exam - Simple Application.

Of the many tax law changes enacted as part of the Tax Cuts and Jobs Act of 2017 TCJA one provision is raising concern among banks involved in certain post-2017. Bank-owned life insurance BOLI is a type of permanent life insurance policy banks buy for high-salaried employees or board members. For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs.

SelectQuote Rated 1 Term Life Sales Agency. The general rule for bank-owned life insurance BOLI is that proceeds received by reason of death are tax free. The bank purchases life insurance on a select group of management including officers or other key personnel.

A form of permanent life insurance owned by banks to offset the future costs of providing employee benefits. Ad 2022s Top Life Insurance Providers. Ad For Final Expenses.

The Office of the Comptroller of the Currency the Board of Governors of the. No Medical Exam-Simple Application. An insurance policy known as bank owned life insurance has a financial entity listed as the owner or beneficiary.

The Interagency Statement on the Purchase and Risk Management of Life Insurance OCC 2004-56 provides general guidance for banks. The Board of Governors of the Federal Reserve System the Federal Deposit Insurance Corporation the Office of Thrift Supervision and the Office of the Comptroller of the. The guidance attached to this bulletin continues to apply to federal savings associations.

Banking organization insurance programs include the funding of employee benefits through purchases of corporate- or bank-owned life insurance and the transfer of insurable. Bank Owned Life Insurance. Ad Shop The Best Rates From National Providers.

For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. Illinois Department of Insurance 122 S. Michigan Ave 19th Floor Chicago IL 60603 312 814-2420.

Bank-owned life insurance BOLI is addressed by North Dakota Administrative Code NDAC 13-02-14 which was last amended April 1 2003. SelectQuote Rated 1 Term Life Sales Agency. The one caveat that must be met is that the policy owner must get informed consent from the employee or employees in question before a bank owned life insurance policy can be taken.

Illinois Department of Insurance 320 W. Reviews Trusted by 45000000. As Low As 349 Mo.

With the exception of term policies occasionally used to cover a borrower while a large debt. Act and Part 362 of the FDICs Regulations Attachments. Prepare with guaranteed life insurance from 995.

Ad Youre eligible to apply for exclusive term life insurance from New York Life. Ad Shop The Best Rates From National Providers. Bank-Owned Life InsuranceInteragency Statement on the Purchase and Risk Management of Life Insurance.

Individuals cannot purchase bank-owned life insurance for themselves. A purchase of life insurance must address a legitimate need of the bank for insurance. The buildup of cash surrender value within the policy is included in book earnings but excluded.

Let them celebrate your life rather than worry about the cost of a funeral. These regulations help banks cut costs on employee. Bank Owned Life Insurance BOLI continues to be a popular investment choice for a variety of banks.

Bank owned life insurance BOLI is life insurance purchased and owned by banks. Interagency Statement on the Purchase and Risk Management of Life Insurance including Executive Summary. As Low As 349 Mo.

Risk management processes for bank-owned life insurance BOLI are consistent with safe and sound banking practices.

Credit Or Loan Insurance Canada Ca

Annuity Beneficiaries Inheriting An Annuity After Death

Mortgage Life Insurance Broker Why You Need One

Federal Register Regulatory Capital Rules Risk Based Capital Requirements For Depository Institution Holding Companies Significantly Engaged In Insurance Activities

Charitable Giving And Life Insurance Giving

Bank Owned Life Insurance Boli

Annuity Beneficiaries Inheriting An Annuity After Death

4 Common Types Of Life Insurance

Measuring What Matters Toward A Quality Of Life Strategy For Canada Canada Ca

:max_bytes(150000):strip_icc()/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Wall Street Pursues Profit In Bundles Of Life Insurance The New York Times

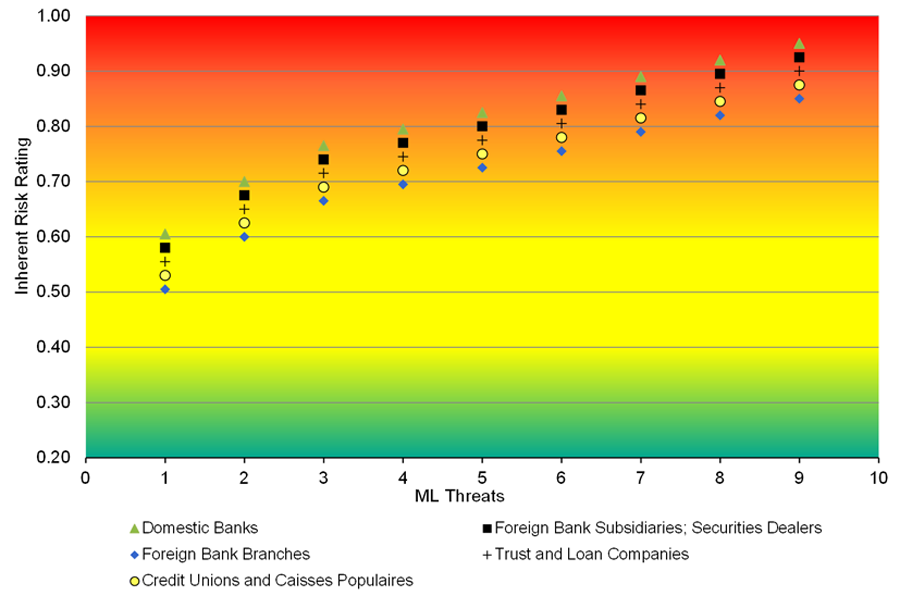

Assessment Of Inherent Risks Of Money Laundering And Terrorist Financing In Canada Canada Ca

:max_bytes(150000):strip_icc()/dotdash-insurance-companies-vs-banks-separate-and-not-equal-Final-9323c943f9974aad96b2c70d6e3aa577.jpg)

Insurance Companies Vs Banks What S The Difference

What Happens If You Lie On Your Life Insurance Application Bankrate